Services

No two single-family townhouses are exactly the same, and valuing a property is an amalgam of art and science.

Multifamily properties range from two family to ten unit buildings and above. We know what factors are most important in valuation

Mixed-use properties, often located along avenues, combine a commercial space with living space above.

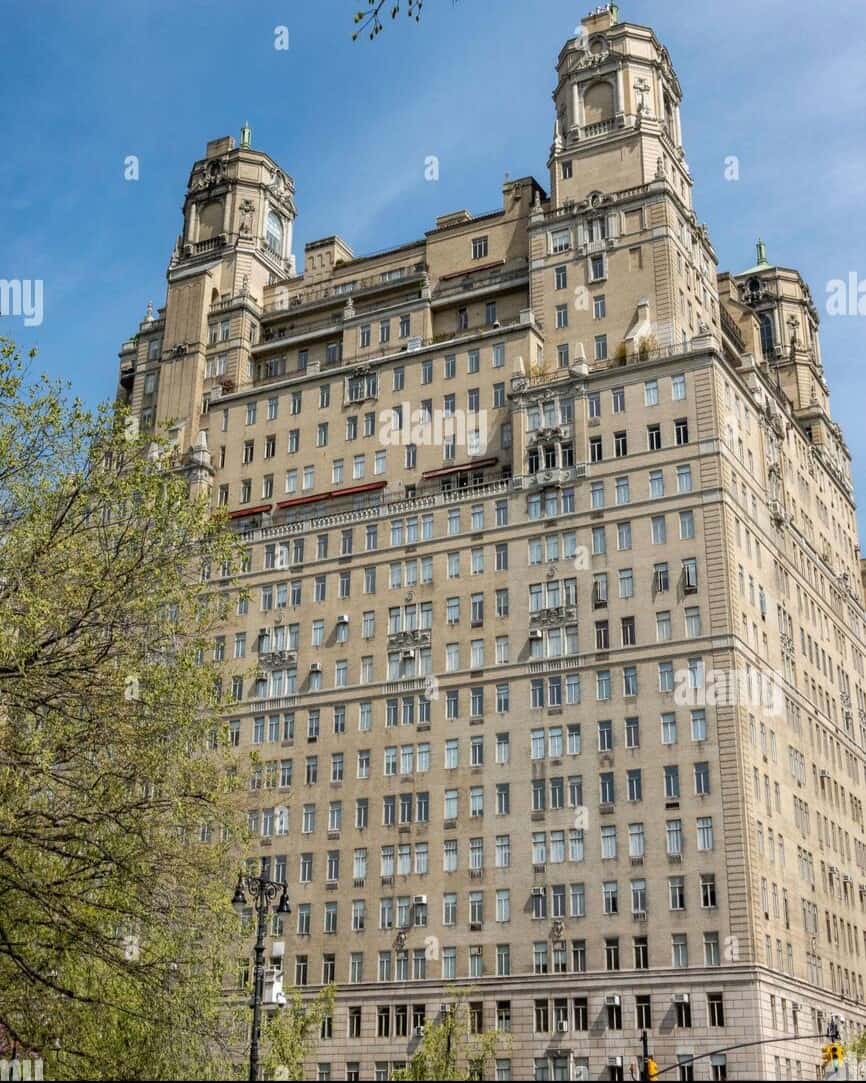

Condominiums are “real property” in the sense that just like a free-standing house, there is a deed, and the owner is responsible for property taxes

“Common Charges” are the monthly fees paid to the condominium board to cover expenses such as building staff, building maintenance, and as a reserve for capital improvements such as elevators, boilers and the roof.

As a condo owner you enjoy the freedom to sublet your unit without encumbrance, and you have more flexibility when selling your property as well.

When you purchase a co-op apartment, you are actually buying shares of stock in the building (corporation), and in tern receive the right to live in your apartment.

As an owner of a co-op apartment, you pay a monthly “maintenance” to the co-op board to cover expenses such as building staff, building maintenance, contribution to a capital expense reserve fund, building debt service, and real estate taxes.

Co-ops are typically less expensive to purchase than an equivalent condo unit, and a portion of your monthly maintenance is tax deductible as well.